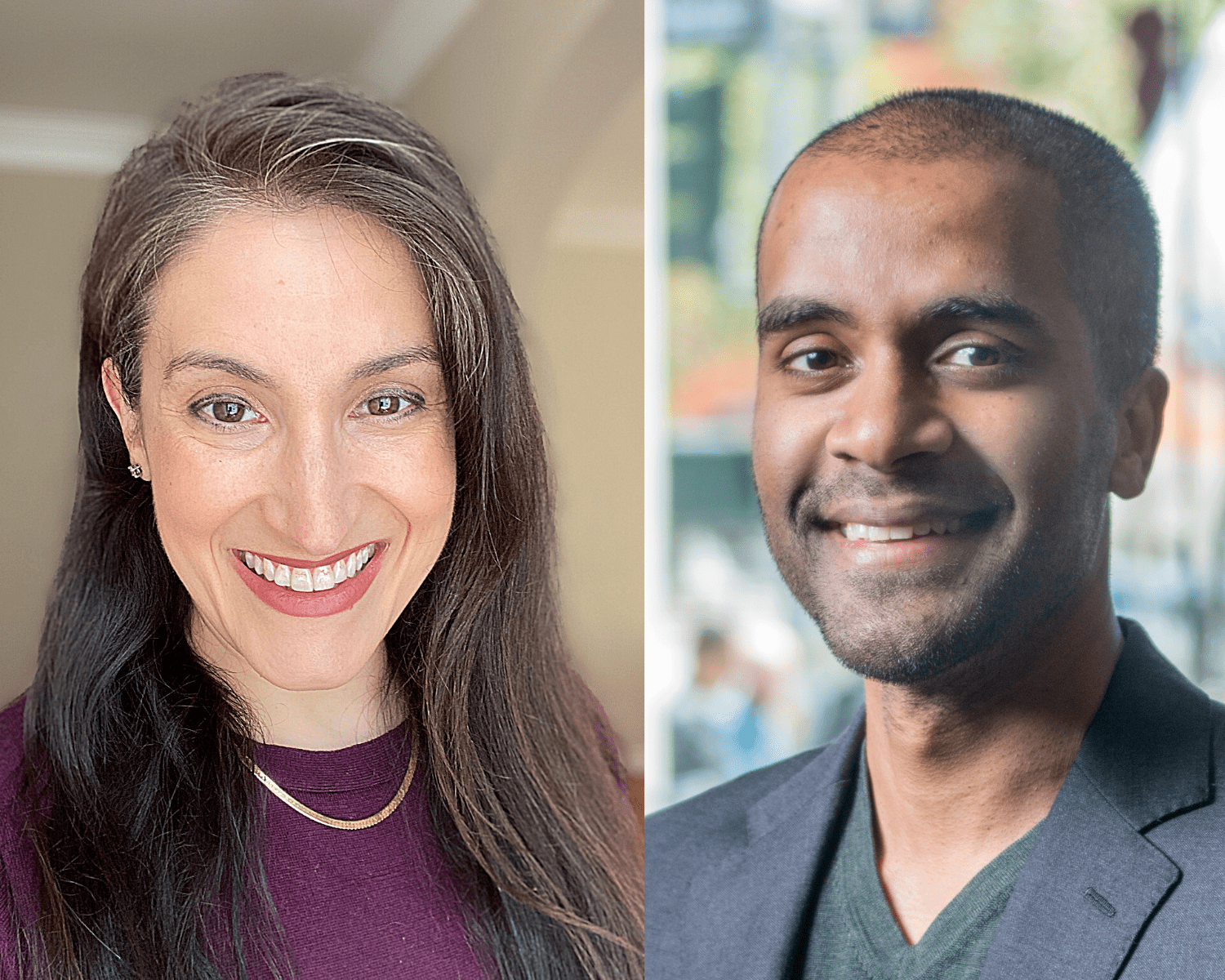

Heather Field

Stephen A. Lind Professor of Law and Co-Director of Center on Tax Law

- Office: 334-200

- Email: fieldh@uclawsf.edu

- Phone: (415) 565-4716

Bio

Heather M. Field is the Stephen A. Lind Professor of Law at the University of California, College of the Law San Francisco (UC Law SF). She leads UC Law SF’s tax law concentration, teaches a variety of tax law courses, and serves as the Co-Director for the UC Law SF Center on Tax Law. Professor Field’s research focuses on tax elections, the effect of tax law on businesses/business transactions, tax risk management, professionalism in tax practice, and tax law pedagogy. She is a frequent speaker on tax law issues, and she has written more than twenty articles.

While at UC Law SF, Professor Field served as the Associate Academic Dean (2013-16), and she has received awards including the Visionary Award (2013) conferred by the UC Law SF Board of Directors, the 1066 Foundation Award for Faculty Scholarship (2009), and the Rutter Award for Teaching Excellence (2008). Prior to joining the UC Law SF faculty, Professor Field was an associate at Latham & Watkins LLP in Los Angeles from 2000 to 2006. Her practiced focused on the federal taxation of corporations and partnerships and involved advising clients on the tax aspects of mergers, acquisitions, dispositions, restructurings, joint ventures, securities offerings, financial products, and structured finance transactions. Professor Field received a B.S. in Biochemistry from UCLA in 1997 and a J.D. from Harvard Law School in 2000, both magna cum laude. Professor Field is admitted to practice law in California.

Education

-

Harvard Law School

J.D. (magna cum laude), Law 2000 -

University of California

B.S. (magna cum laude), Biochemistry 1997

Selected Scholarship

-

Allocating Tax Transition Risk

73 Tax L. Rev. 157`` 2020 -

Tax MACs: A Study of M&A Termination Rights Triggered by Material Adverse Changes in Tax Law

73 Tax Law. 823 2020 -

A Tax Professor’s Guide to Formative Assessment

22 Fla. Tax Rev. 363 2019 -

Tax Lawyers as Tax Insurance

60 Wm. & Mary L. Rev. 2111 2019 -

A Taxonomy for Tax Loopholes

55 Hous. L. Rev. 545 2018 -

Aggressive Tax Planning & the Ethical Tax Lawyer

Virginia Tax Review 2017 -

Fostering Ethical Professional Identity in Tax: Using the Traditional Tax Classroom

Columbia Journal of Tax Law 2017 -

The Real Problem with Carried Interests

UC Law SF Journal 2014 -

Binding Choices: Tax Elections & Federal/State Conformity

Virginia Tax Review 2013 -

Throwing the Red Flag: Challenging the NFL's Lessons for American Business

Journal of Corporation Law 2013 -

The Return-Reducing Ripple Effects of the 'Carried Interest' Tax Proposals

Florida Tax Review 2012 -

Choosing Tax: Explicit Elections as an Element of Design in the Federal Income Tax System

Harvard Journal on Legislation 2010 -

Checking In on "Check-the-Box"

Loyola Los Angeles Law Review 2009